Student loan forgiveness

The loan forgiveness policy creates an incentive for borrowers to consolidate Federal Family Education Loans owned by MOHELA into Direct Loans owned by the government depriving them MOHELA. President Joe Biden announced on Aug.

This is available to government and certain nonprofit employees with federal student loans.

. James MartinCNET When will the student debt forgiveness application launch. More information on 1098-E. Announced in late August the plan will deliver federal student loan.

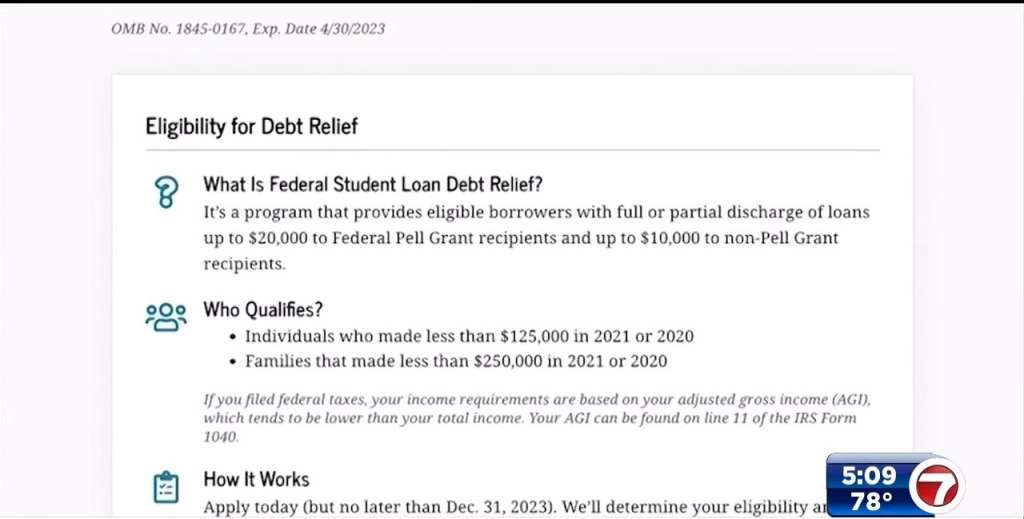

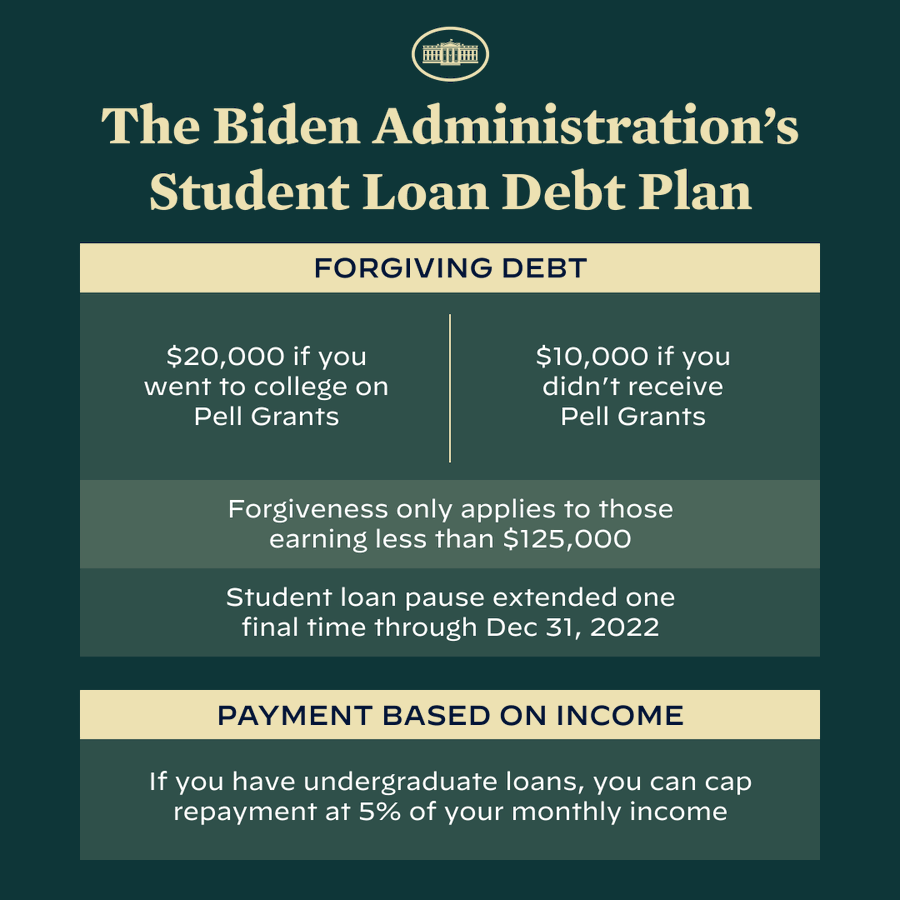

You could be eligible for 10000 to 20000 in student loan debt forgiveness. 24 that most federal student loan borrowers will be eligible for some forgiveness. If you repay your loans under a repayment plan based on your income any remaining balance on your student loans will be forgiven after you make a certain number of payments over a certain period of time.

Up to 10000 if they didnt receive a Pell Grant which is a type of aid. Department of Education announced it will make 11 billion in closed school discharges available to an additional 115000 borrowers who attended the now-defunct ITT Technical Institute ITT. Under the scheme you could be eligible for your remaining loan balance to be forgiven tax-free after youve made 120 qualifying loan payments.

Student loan interest payments are reported on the IRS Form 1098-E Student Loan Interest Statement. One of the major national student loan forgiveness programs is Public Service Loan Forgiveness. Federal Student Aid.

August 26 2021 Extended Closed School Discharge Will Provide 115K Borrowers from ITT Technical Institute More Than 11B in Loan Forgiveness Today the US. Learn about IDR plans and how to. The application for President Joe Bidens student loan forgiveness plan is expected to go live as soon as this week.

Public Service Loan Forgiveness PSLF. Income-Driven Repayment IDR Plans. Check the American Federation of Teachers website to get a list of loan forgiveness and other.

You can qualify for a PSLF loan if youre a full-time employee of a federal. Are there any other student loan forgiveness programs. 1098-E Tax Form.

If you made federal student loan payments in 2018 you may be eligible to deduct a portion of the interest you paid on your 2018 federal tax return.

Biden Student Loan Forgiveness And Extension Plan What To Know Teen Vogue

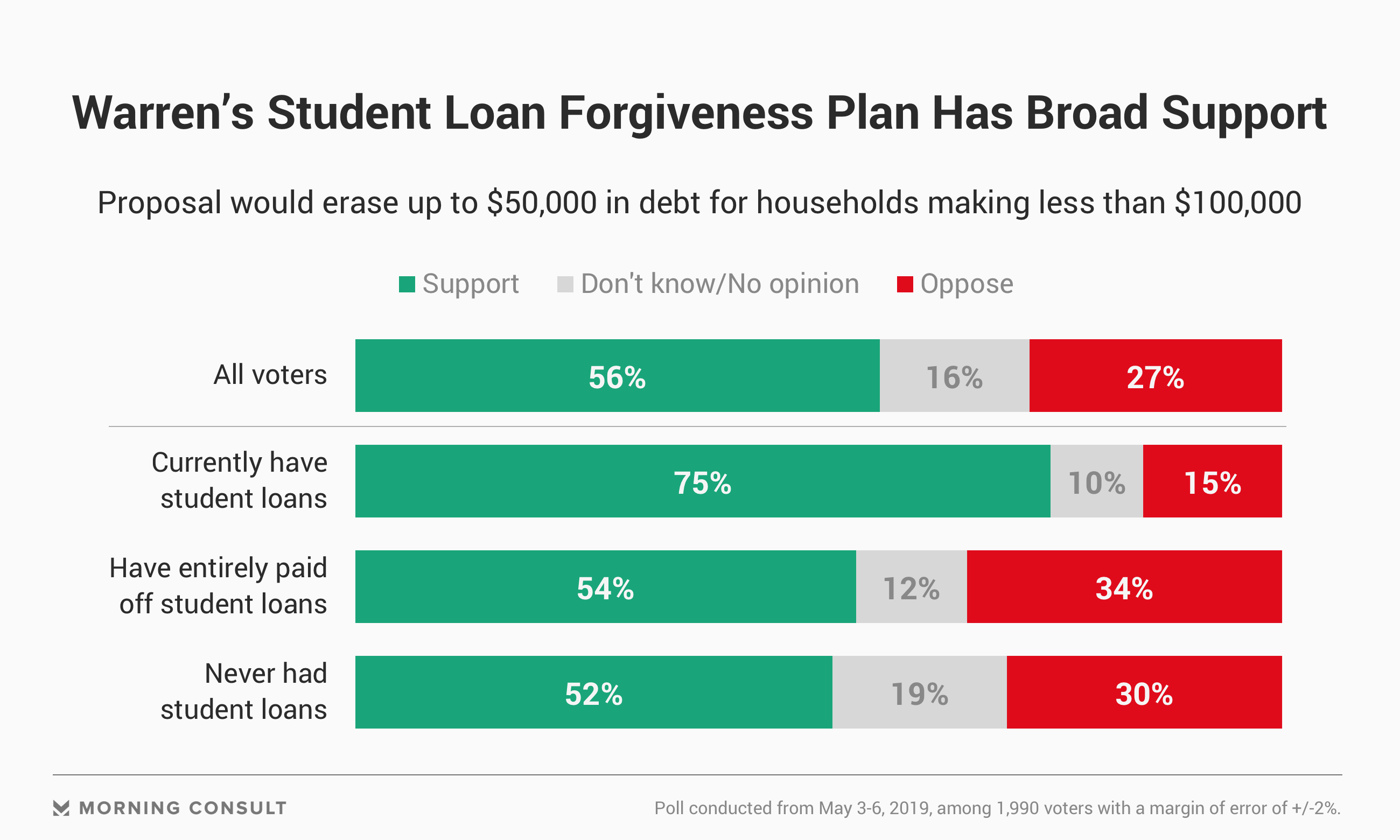

Elizabeth Warren S Student Debt Forgiveness Plan Popular With Voters

What Are The Pros And Cons Of Student Loan Forgiveness

Policy Options For Student Loan Forgiveness Student Aid Policy

And Now What The Question That Followed Biden S Student Loan Forgiveness Plan Npr

Thanks To Union Advocacy Student Loan Forgiveness Is A Reality

Conservatives Are In A Legal Battle To Stop Biden S Student Loan Forgiveness Npr

How To Avoid Student Loan Forgiveness Scams Federal Student Aid

Student Loan Forgiveness Application Officially Launches

Biden S Student Loan Forgiveness Application Form Is Here How To Apply Now Cbs News

Ftc 5 Red Flags To Spot Student Loan Forgiveness Application Scams

Student Loan Forgiveness Application Is Available Here S What To Do

Student Loan Forgiveness Could Help 1 4 Million In Michigan What To Know Bridge Michigan

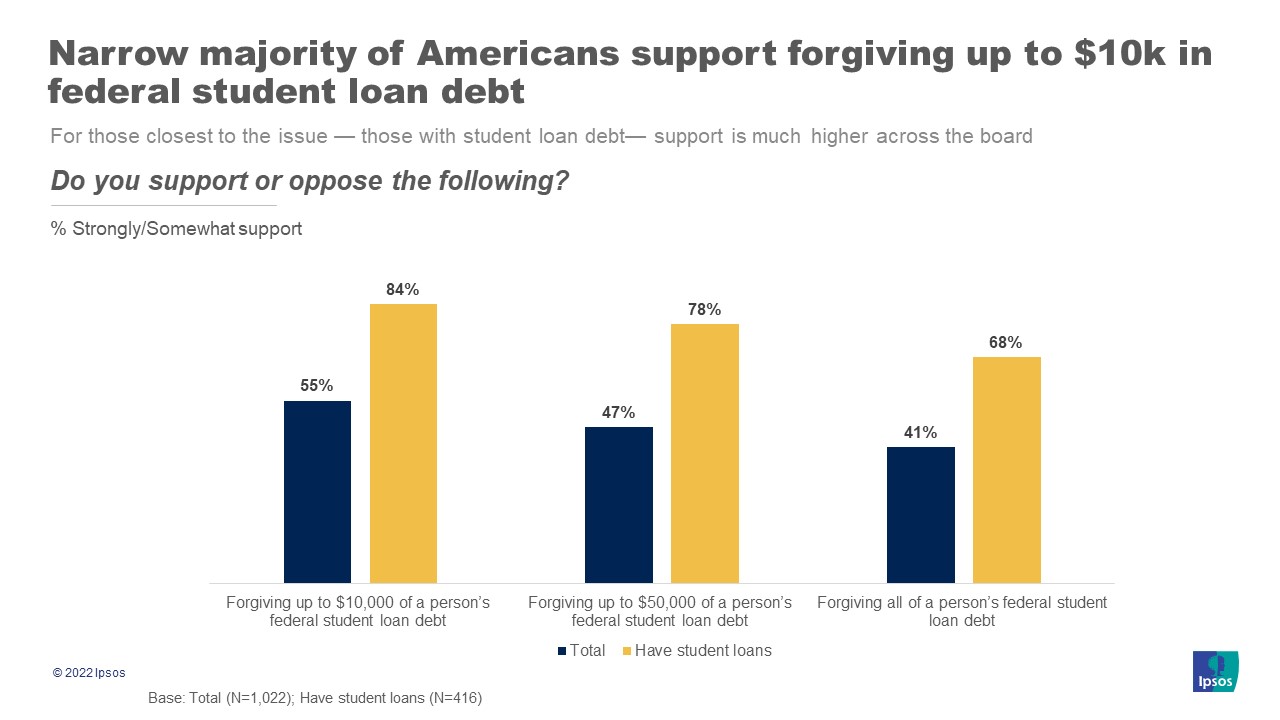

Support For Student Loan Forgiveness Varies Widely Between The American Public And Those With Loans Ipsos

Public Service Loan Forgiveness Do You Qualify For It Student Loan Hero

/cloudfront-us-east-1.images.arcpublishing.com/pmn/NN3ZZVBZDNFAZHYJXYL26PZ7QA.jpg)