sales tax on clothing in buffalo ny

Sales Tax 5 years ago Save 875 If youre clothing total is under 110 I believe the 4 NYS tax is waived. Burlingham NY Sales Tax Rate.

Cities With Highest Sales Tax Sales Tax Rates By City Tax Foundation

Traffic deaths that began two years ago is continuing into.

. Last spring legislators voted to drop its four percent share of the sales tax on clothing and footwear purchases under 110. The minimum combined 2022 sales tax rate for Buffalo New York is. Buffalo NY Sales Tax Rate Buffalo NY Sales Tax Rate The current total local.

Clothing and Clothing Accessories Store in Buffalo Erie County. PO Box 13480 BUFFALONew York 14218. Anything above this amount is considered a luxury item.

Clothing footwear and items. The New York state sales tax rate is 4 New York Sellers permit. If youre clothing total is under 110 I believe the 4 NYS tax is waived.

That is until the state again changed the rules. Products services and transactions subject to Sales Tax get Sellers Permit in the State of New York. To help ease that shock Sen.

The National Association of Realtors said Thursday that sales fell 202 from July last year. Like Massachusetts New York and New York City offer exemptions for most clothing items up to 110. There is no applicable city tax or special tax.

So you would end up with just the 475 county tax. This is the total of state county and city sales tax rates. Get Licening for my Clothing and Clothing Accessories Store tax id in 14208 Buffalo nystate id taxTax ID Registration Requirements for Clothing and Clothing Accessories.

The New York sales tax rate is currently. The December 2020 total local sales tax rate was also 8750. Is an Ein The Same as a Sales Tax ID.

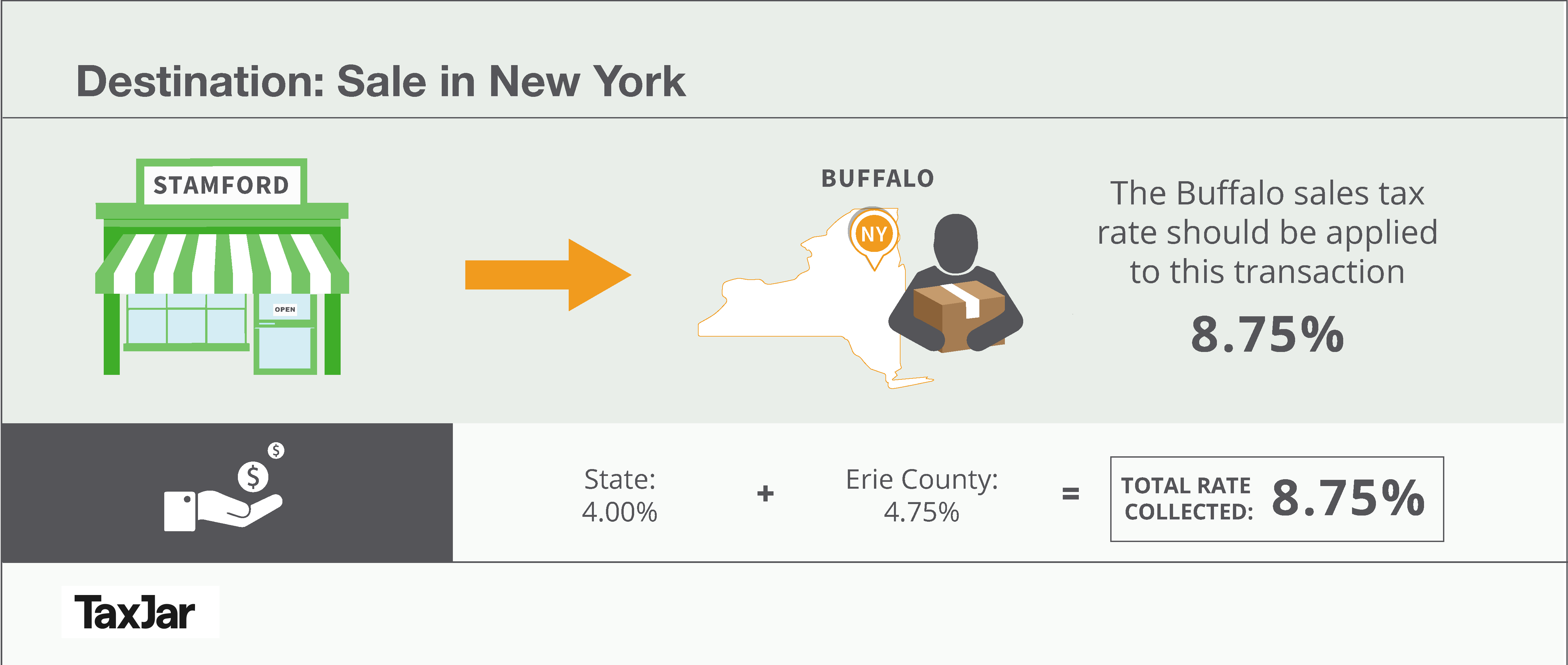

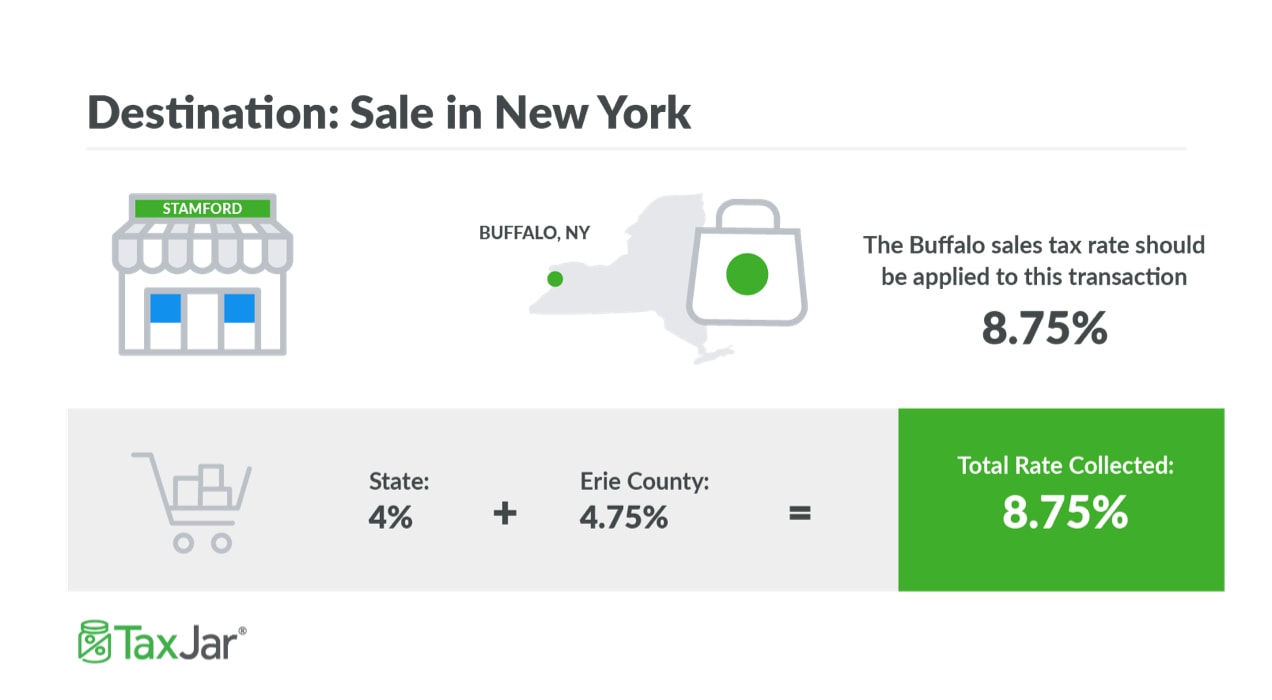

The 875 sales tax rate in Buffalo consists of 4 New York state sales tax and 475 Erie County sales tax. You can print a 875 sales tax. At any rate in 1045 area you have to.

Buffalo is located within Erie County New York. Buffalo NY Sales Tax Rate. The trend of rising US.

The current total local sales tax rate in Buffalo NY is 8750. Buffalo NY Sales Tax Rate Buffalo NY Sales Tax Rate The current total local sales tax rate in Buffalo NY is 8750. Borrello has introduced legislation that would raise the states 4 sales tax exemption on a single item from 110 to 250 on items such as winter.

This includes the rates on the state county city and special levels. The average cumulative sales tax rate in Buffalo New York is 875. While dropping the county sales tax on clothing and footwear would save shoppers money it would cost the Village of Williamsville nearly 21000 in lost tax revenues.

New York Sets 7 Month Gas Tax Holiday Local News Buffalonews Com

The Consumer S Guide To Sales Tax Taxjar Developers

Legislation On The Table To Increase Ny Sales Tax Exemption

Legislation On The Table To Increase Ny Sales Tax Exemption

Sales Tax Increases In Wayne County For Clothes And Shoes Rochesterfirst

Buffalo Ny 1910 Postcard Main Street Downtown Looking North New York Ebay

Amazon To Get 124m Tax Break To Build Niagara Warehouse Report

Ingram Micro Wins Tax Breaks From Amherst Ida

Buffalo Restaurateurs Vocal In Support Of Delaying Sales Tax Payment Local News Buffalonews Com

Blues Brothers Chateau Inn Buffalo Ny Concert Poster 11 X 17 143 Ebay

How To Avoid New York Sales Taxes At The Mall Newyorkupstate Com

New York Resale Certificates For Businesses Legalzoom

Thrift Shop Hearts For The Homeless

How To Avoid New York Sales Taxes At The Mall Newyorkupstate Com

Buffalo Ny Area Cpa Practice For Sale In Buffalo New York Bizbuysell

How To Charge Your Customers The Correct Sales Tax Rates

Taxes Visit The Usa L Official Usa Travel Guide To American Holidays